In the past, Indians have always preferred traditional methods of investment: gold, real estate, bonds and shares. However, with an increase in financial literacy and investment acumen our preferences are changing, as more and more people have started opting for other forms of investment, including investing in mutual funds. The total assets under management (AUM) to GDP ratio, used to assess the rate of mutual funds penetration into the country, used to be around 10% in the country, way below the global average of 55%. In fact, countries like Australia and the United States have shown AUM rates of over 100%.

However, these figures have shown a drastic change, with the mutual funds asset base estimated to have increased to over Rs. 23 lakh crores in 2017-18, due to a push in investment campaigns by the industry and improved mutual funds penetration in smaller towns, backed by the efforts of the Securities and Exchange Board of India.

Despite the well-known benefits of mutual funds, which include offering investors diversified risks, access to markets with low costs of transactions and liquidity, India, which has one of the highest gross domestic savings rate of 28%, couldn’t expand its savings in mutual funds. In 2013, a report published by consulting firm, PricewaterhouseCoopers, revealed that AUM across the country was highly concentrated in the top 15 cities, which contributed to about 87% of the entire countries AUM. Taking this into account, the SEBI aimed to reduce the regulatory and distributional challenges faced by mutual fund houses and pushed for increasing the penetration of mutual funds in smaller cities, which remained to be a huge untapped market.

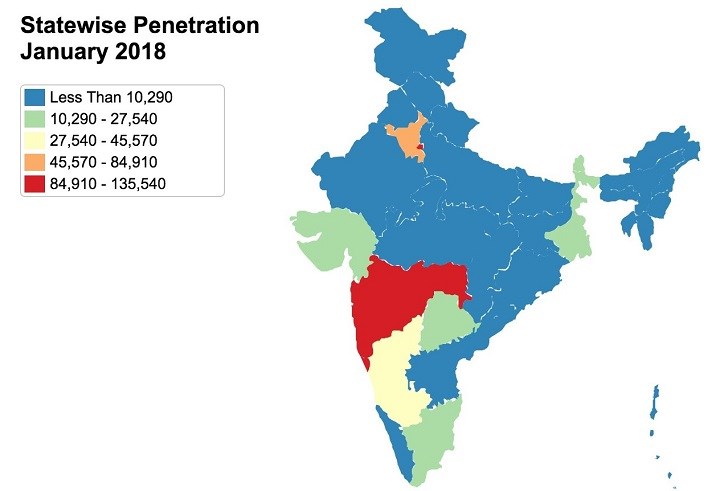

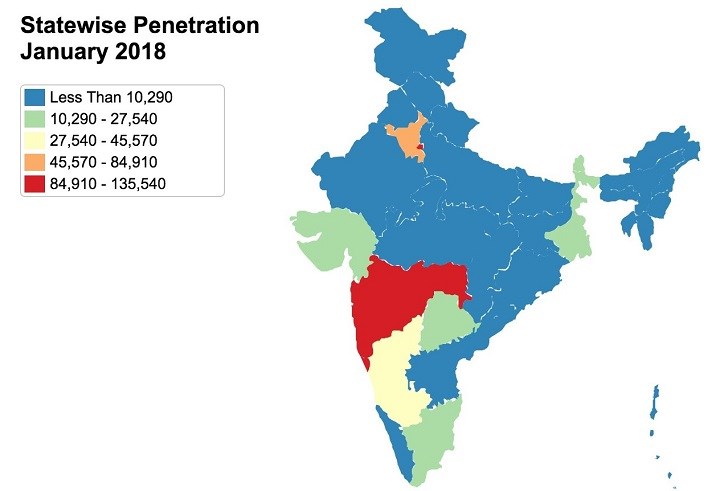

State wise Penetration of Mutual Funds across India (Source: Association of Mutual Funds in India)

Mutual funds distributors have not only been helping investors in such cities understand what schemes to invest in, but also helping them understand how to navigate effectively through volatility in markets, thus helping them be more confident and secure about investing in mutual funds. This was particularly important during the 2015-16 financial year, when despite a falling market, there was a steady positive inflow into the mutual funds industry due to distributors going to next mile to help customers keep their investments and invest more at low next asset values (NAV).

Another major cause of improved mutual fund penetration in the country is digitalisation, which has led to an overall shift in investment to financial securities rather than traditional assets. Digitalisation has penetrated in every industry and market, transforming the way industries operate, and the mutual funds market is no different. A market report published by Ernst and Young discussed the impact of digital business value drivers on the mutual funds market. Due to the increase use of digital access points, such as the ability to research and purchase mutual funds online and on mobile, there has been an increase in customer demand for the same.

Additionally, due to digitization, customers also feel more empowered and confident about their investments, as they have access to more sources of online trading, direct-to-consumer advisors and low cost automated solutions for portfolio and risk management. Combined with the personalised service offered by mutual fund houses due to their ability to predict customer and tastes and preferences by using big data analytics, on an average about 3.38 lakh new portfolios are added to the market every month in the last two years. Digitalisation is seeping into the already growing industry, prompting more and more people to invest into mutual funds.

As we trace the growth of the mutual funds market in a post-demonetised nation, we see there is a push to invest in financial products as customers feel more confident about their ability to evaluate the risk, growth and vulnerability of such products. Mutual fund houses have been going the extra mile to help customers understand the benefits and ease of investing in mutual funds have all expanded the industry from Rs. 5.87 trillion in 2012 to over Rs. 15.63 trillion in 2016. With a consistent and steady economic growth of 7.4% for the last quarter, the Indian economy is slowly recovering from its slowdown, and this is likely to increase investments in the sector further, with plenty of more room for expansion.

No comments:

Post a Comment