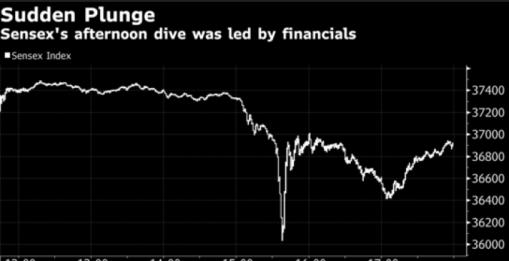

Nifty and the Sensex saw a sharp correction on Friday, the last trading day of the week as financials rocked the Nifty boat. The Sensex at one point of time was down by over 1000 points and the Nifty had plunged below the 11,000 mark before semblance of sanity returned to the markets. There were 5 principal factors behind the sharp crash in the market on 21.09.2018

- Yes Bank took its toll on the banking sector as a whole

Yes Bank was sharply down nearly 30% on Friday after being as much as 34% down at one point of time. Volumes were sharply higher on Friday indicating some concerted institutional selling on the stock. The stock was downgraded by a slew of brokers after the RBI refused to allow Rana Kapoor to continue as the CEO of the bank after January 2018. The RBI has been quite choosy about permitting CEOs to continue and even in the case of Axis Bank the RBI had actually compelled Shikha Sharma to move on after December. This had a spill-off effect across the banking stocks as the BSE Bank index corrected as much as 3.5% in a single day.

- IL&FS debt returned to haunt financials

With IL&FS getting closer to an absolute liquidity crunch and defaulting on its ICDs and CPs, the RBI has started tightening the vigilance on banks and other financial institutions. For starters, the RBI asked banks to be cautious about buying HFC bonds considering their exposure to IL&FS debt. IL&FS has outstanding debt to the tune of $12.5 billion and the market is rife with news that most of the HFCs have large exposure to IL&FS debt. Of course, the promoters of Indiabulls and DHFL have denied any exposure but the news refuses to go away. The mood was also sourced by a large Indian mutual fund selling DHFL bonds in the market at an above-market yield of almost 11%. That also took its toll on the markets.

- Basket selling on financials and rich valuations

If you break up the components of the correction, the entire fall was concentrated in financials and other sectors where there are valuation concerns. Even within the large cap space, the correction was sharpest in stocks like Kotak Bank, Adani Ports, Bajaj Finserv, Bajaj Finance etc where there already are valuation concerns. The basket selling was largely restricted to stocks like Yes Bank, Indiabulls and DHFL, which were in the news as well as stocks where valuation concerns have been around for quite some time.

- Macros are still a worry for the markets

The macros continue to be a worry for the markets. The trade deficit is consistent at around $18 billion per month and CAD is likely to get closer to 3% of GDP by year end. Oil prices are close to $80/bbl while the INR has already cracked close to 73/$. All these factors may force the RBI to hike the repo rates by 25 basis points to 50 basis points which is likely to be a negative factor for the stock markets. That risk also got factored into the markets on Friday. In a nutshell, with all the macro uncertainties, most traders were trying to go into the week end as light as possible.

- Finally, the Fed rate outlook Is also an overhang

The US Fed meets on September 26th but the CME Fed tool is already indicating a probability of 95% for a rate hike by the Fed. That is not good news for the Indian markets. It will impel the RBI to front end another rate hike to prevent any risk of capital market outflows. Also higher Fed rates will lead to a stronger dollar and that by itself will put pressure on the INR, which is already vulnerable at this point of time.

The sharp correction on Friday was a mix of valuation concerns, technical issues, debt contagion worries and a mix of domestic global macros. This has been a week of consistent weakness in the market and the INR and the bond yields could be the overhang

No comments:

Post a Comment