Reel life is inspired by Real life and at times it is vice versa. Movies started way back in 1900s and craze & popularity is increasing with each passing year.

Let me admit, I am a big movie Buff and I switch on TV for only movies.

Tanu weds manu Returns:

Don’t raise your Expectations to an Unreasonable level.It’s been four years since Tanu and Manu’s eventful wedding and they’re already feeling the seven year itch. Settled in London, their relationship is now as cold as the London winter. While Tanu expected her husband to be flamboyant, Manu wanted a docile and peaceful wife. Expectations play a spoilsport here.

Similarly, in investments, the key issue is not the return that one gets on his investment but the expectations that are being set is an issue. After getting decent returns, the greed is not satiated which is the mere cause of discontentment. Firstly, the expectations have to be set right, they have to be realistic and not unreasonable.

Bhaag Milkha bhaag:

Hard work has no substitute. The amount of Hard work Milkha Singh puts in his passion is commendable. He is not even aware about day and night, hot and cold at times. He is aware about one single thing i.e his win and breaking the record. He could do so because he kept thinking about the outcome of his efforts.Likewise, we will have to work hard to get good results. “What we sow is What we reap.” We will have to keep sowing to reap tasty fruits. Stay disciplined and committed by investing regularly without any miss thinking about the outcome everytime.

Never Race: Don’t ever race just because someone else doing it . It is time to unfollow the herd mentality and break the patterns. In Financial planning, It is time to leave traditional and not so suitable products with New products which are better in all aspects. For example: An endowment life insurance policy should be replace with Mutual funds and term insurance for better return , risk cover and taxation.

Baghban and Munnabhai :

Don’t Transfer your assets during your lifetime:The first and foremost goal while planning for finances should be to secure your retired life as those will be the years when you need the most support. Retirement statistic show that nearly 68% of people are dependent on others for post retirement expenses. Both these movies are excellent examples of what not do while planning for your retirement. Always, keep assets in your name and find ways to alternate income and write a “Will” well in time for distribution of financial assets after you as per you wish.

Udaan:

Do what you think is right: Chase your dreams and take the flight.

There will be lot of obstacles, but persistence will take your where you want to go. Keep walking towards your goal . Two things that help reach desired results in life and investments are: Discipline and time .

Live life to the fullest. It is your thoughts that can take over anything and everything. If you wish to see positivity around despite all odds, you will see positive things and vice versa.

In investments, if you are too much listening to or attracting negative news which are due to external factors and is beyond control , it is not going to help. It is a temporary phase and short term volatility.By saying , All is well, not only the tensions will vanish but also , you will be reaching where you were headed to in a smooth manner.

Lagaan:

The Biggest risk is the one that you don’t take. One can not discover new oceans unless you have the courage to lose sight of the shore. The movie is about a young man named Bhutan who challenges British to oppose double tax levied with game of cricket for which the villagers had no idea on how to play. He took risk and won in the end.

Risk of losing by investing in equities is much lower than actually keeping money idle or in instruments which yield lesser than inflation and depreciating its value.

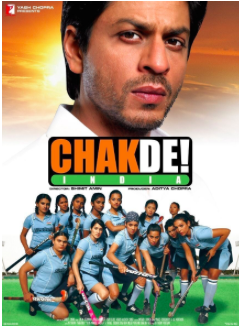

Chak de India:

Planning is very important before execution. It is very important to prepare the roadmap before starting the journey. The hockey coach did accurate planning and practice before sending the girls to get the world cup.

Similarly, for effective planning for financial goals, a roadmap is to be prepared as to what all steps need to be followed, what all milestones need to be reached and so on.

One size doesn’t fit all. An eight year old boy is thought to be lazy and troublemaker, unless a new art teacher discovers the real problem behind his struggles in school.Every child is unique and has a unique set of talents, which requires nurturing and encouragement.

When it comes to personal finance, remember it is personal finance and has to be personal for everyone. It can not be same for two people as each one of us have different lifestyles, needs, goals and income.

No comments:

Post a Comment